Get the free personal bond format pdf

Show details

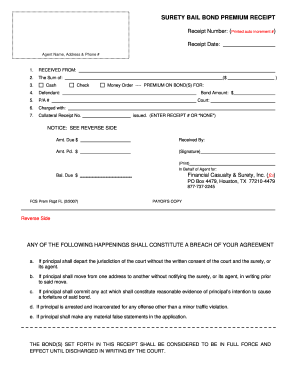

MISSOURI DEPARTMENT OF NATURAL RESOURCES GEOLOGICAL SURVEY PROGRAM PERSONAL BOND ? SECURED BY SURETY BOND NAME OF SURETY ADDRESS CITY STATE ZIP CODE As Surety, authorized to do business in Missouri,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal bond sample form

Edit your personal bond form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to fill up personal bond form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal bond format pdf online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit personal bond format pdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal bond format pdf

How to fill out personal bond format pdf?

01

Start by opening the personal bond format pdf on your computer or mobile device.

02

Fill in your personal information such as your full name, address, and contact details in the designated fields.

03

Provide any necessary identifying information such as your date of birth, social security number, or driver's license number.

04

Indicate the purpose of the bond and the amount involved, if applicable.

05

Include any additional information or details required by the specific bond format, such as the names of co-signers or witnesses.

06

Carefully review the completed form to ensure all information is accurate and legible.

07

Save or print the filled-out personal bond format pdf for your records.

08

If required, sign the form electronically or physically, depending on the instructions provided.

Who needs personal bond format pdf?

01

Individuals who are required to provide a personal bond for legal or financial purposes may need a personal bond format pdf.

02

This may include individuals involved in legal proceedings, such as defendants or litigants, who need to provide a bond as a guarantee of their appearance in court or compliance with certain conditions.

03

Additionally, individuals seeking financial assistance or engaging in certain business transactions may require a personal bond format pdf to demonstrate their commitment to fulfilling their obligations.

Overall, the personal bond format pdf is essential for anyone who needs to provide a bond and wants a standardized format to fill out and submit their information accurately.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a security bond?

It can be simply described as the guarantee given by the surety firm to compensate the first party if a second party does not fulfill the obligations. If the necessary obligations are not fulfilled, a claim can be made on the bond.

How do you fill out a bond form?

A person must sign the bond when a principal signature is prompted. If the bond is in an individual's name, the principal must provide his or her signature, matching his or her legal printed name. In the case that the principal is a company, an authorized representative will sign the bond where indicated.

What is personal security bond?

A personal surety bond is what some consider to be the original type of surety bond. It is where an individual would need to make a financial guarantee to a third party and they would ask a friend or family member to post the money on their behalf sometimes for a fee or interest.

What are the benefits of a security bond?

Advantages of Surety Bonds They shield the obligee from potential losses if the principal fails to meet contractual obligations. This risk management tool can be instrumental in preventing financial loss, making surety bonds an attractive proposition in many business transactions.

What is an example of a surety bond?

Examples of Surety Bonds Includes bid or proposal bonds, performance bonds, payment or labor and material bonds, maintenance bonds and supply bonds. These bonds are required by state or federal law for most public construction projects or by a private developer.

What is Section 437 A?

CrPC Section 437A. Bail to require accused to appear before next appellate Court.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal bond format pdf for eSignature?

Once your personal bond format pdf is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit personal bond format pdf on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share personal bond format pdf on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out personal bond format pdf on an Android device?

Use the pdfFiller Android app to finish your personal bond format pdf and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is personal bond format pdf?

A personal bond format PDF is a legal document that outlines the conditions under which a person is released from custody, typically requiring them to commit to appearing in court for future proceedings.

Who is required to file personal bond format pdf?

Individuals who have been arrested or are facing legal charges may be required to file a personal bond format PDF to secure their release from detention.

How to fill out personal bond format pdf?

To fill out a personal bond format PDF, individuals must typically provide personal information such as their name, address, and details of the case, along with signatures from the bonded party and possibly a guarantor.

What is the purpose of personal bond format pdf?

The purpose of a personal bond format PDF is to ensure that a defendant returns for their court appearances while allowing them to remain free during the legal process.

What information must be reported on personal bond format pdf?

The personal bond format PDF must include the defendant's personal details, case number, terms of the bond, signatures, and any other required legal references specific to the jurisdiction.

Fill out your personal bond format pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Bond Format Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.